Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you’re ready to take control of your money — even if you feel behind, overwhelmed, or unsure where to start — you’re in the right place. Building wealth begins with beginner money habits that anyone can develop. You don’t need a high salary, you don’t need to be perfect with finances, and you don’t need to know everything to get started. You just need to begin.

Wealth is not built in a day — it’s built through small financial choices repeated consistently over time. These beginner money habits will help you reduce stress, grow your net worth, and give you more confidence and control over your financial future.

Let’s break them down step by step.

This is the foundation of all beginner money habits. If your expenses always rise to meet your income, wealth becomes impossible. Spending less than you earn is not about depriving yourself — it’s about giving your money direction instead of letting impulses control it.

Most people don’t realize how much money slips away on:

A powerful beginner money habit is simply tracking your spending for one week. You learn more about your finances in 7 days of tracking than in 7 years of guessing.

You are not “cutting back because you’re broke” — you are controlling spending because your future matters.

This is one of the most important beginner money habits used by wealthy people. Instead of saving whatever is left after spending, you save first — and spend what’s left afterward.

Saving becomes automatic, not optional.

Start small:

The moment you pay yourself first, your brain starts accepting a new identity:

“I am someone who builds wealth.”

Automation protects you from emotional spending and low-motivation days.

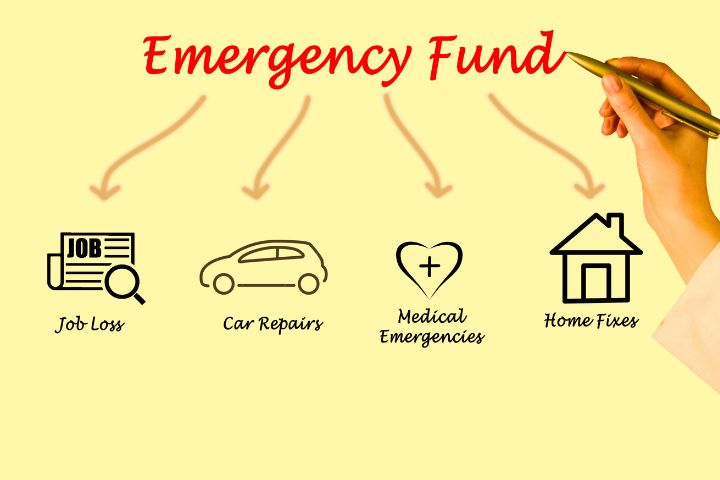

An emergency fund protects all your beginner money habits. Without it, a single unexpected event can wipe out months of progress.

Emergencies happen to everyone:

With an emergency fund, these become setbacks — not disasters. Financial stress decreases dramatically when your brain knows you’re safe.

Build it step-by-step:

You’re not preparing for disaster — you’re preparing for peace.

Saving protects your money. Investing grows it. One of the most powerful beginner money habits is investing early — even if the amounts are tiny at first.

Fear stops most beginners:

“I’ll start when I earn more.”

“I need to learn more first.”

“I don’t want to lose money.”

But wealth comes from starting — not from waiting.

Even €25–€100/month in ETFs or index funds can transform your financial future thanks to compound interest.

📌 Read next: How to invest your first 100 euro

How to Invest Your First €100 in 2025 (Simple Beginner Guide)

Investing builds confidence. Every contribution — no matter how small — is proof that the future version of you matters.

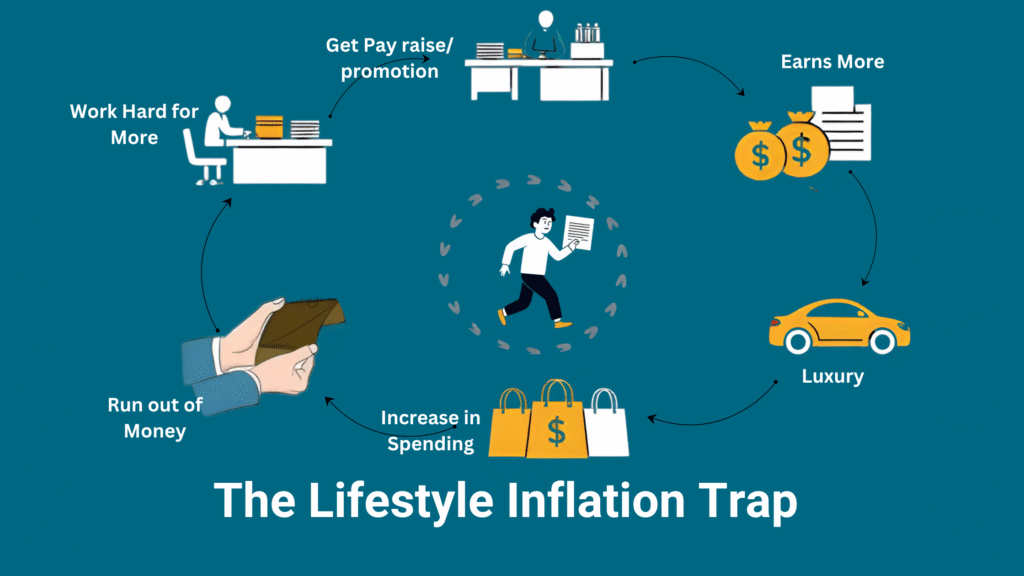

Lifestyle inflation is one of the “silent killers” of wealth. When income rises, spending rises automatically — newer phone, nicer apartment, more nights out. Without realizing it, you earn more but never feel richer.

A smart version of this beginner money habit:

When income increases → increase investing first, lifestyle second.

Example:

Raise of €200/month → €120 to investing, €80 to lifestyle upgrades

You still enjoy life — but you also build freedom.

Tracking income doesn’t measure wealth — tracking net worth does. This is one of the most underrated beginner money habits because motivation grows when progress becomes visible.

Net worth = What you own – What you owe

Track it once a month — even if progress seems small. Every €20 improvement is proof you’re moving forward.

You stop thinking “I’m bad with money” and start thinking:

“I’m improving — and I can keep improving.”

Identity change is the most powerful financial tool on earth.

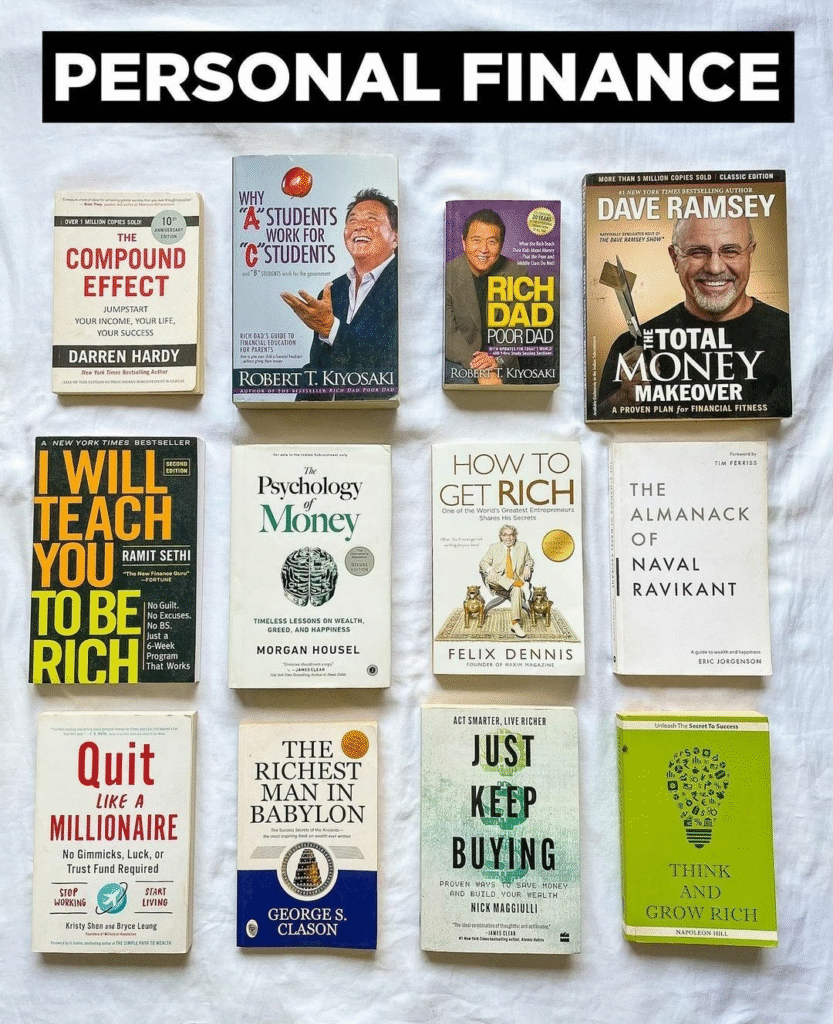

Continuous learning accelerates all beginner money habits. A single financial lesson can save you thousands of euros in mistakes — and decades of stress.

Here are three beginner-friendly books that have changed millions of lives:

📌 Explore next: Best 13 books for investors

13 Best Books for Beginner Investors — Your Guide to Learning Wealth From Scratch

The more you learn, the easier everything else becomes.

This is one of the toughest beginner money habits — not because investing is hard, but because fear is loud. And fear always shows up before confidence.

The truth is:

Confidence doesn’t appear first.

Action appears first — confidence follows.

You don’t need to be fearless to invest. You just need to start small and stay consistent.

📌 Read next: How to invest when you’re scared to lose money

how to start investing when you’re scared

Your courage today becomes your confidence tomorrow.

Comparison steals motivation and joy. Your journey doesn’t need to look like anyone else’s. Some people start early, some late. Some earn more, some less. Some grow slow, some fast.

The only person you need to compete with is your past self.

📌 Read next: How to invest if you have a low salary (€1,600/month or less)

how to invest on a low salary

Slow progress is still progress — and compound growth rewards consistency.

To make all these beginner money habits simple to start:

Week 1 — Awareness

Track every euro you spend

Calculate your net worth (even roughly)

Week 2 — Control

Automate saving (any amount)

Start a mini emergency fund

Week 3 — Protection

Continue emergency fund

Cancel one unnecessary expense

Week 4 — Growth

Choose an investing platform

Make your first investment — any amount

You do not need dramatic change.

You need sustainable change.

You deserve financial freedom. You deserve peace of mind. You deserve options. You deserve a future where money supports your life — not controls it.

These beginner money habits do not transform your life overnight. They transform your life over time. Quietly. Steadily. Permanently.

Every euro you save, invest, or protect sends a message to your future self:

“I’m building something for you. I’ve got your back.”

You’re not behind.

You’re beginning. 💛